Home Equity Loans from Community Choice

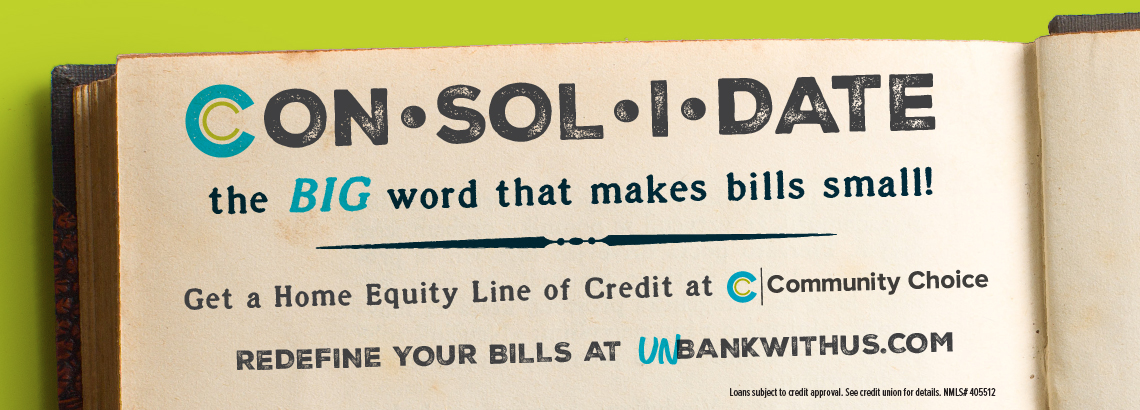

REDEFINE YOUR BILLS

By consolidating with a Home Equity Line of Credit from Community Choice!

-

No closing costs

-

Takes less than 60 seconds to get started

Loan rates and approval subject to credit score and analysis. See credit union for details. Loan rates subject to change without notice. Equal opportunity lender. This credit union is federally insured by the National Credit Union Administration.

See current loan rates and disclosures.

See current loan rates and disclosures.